The British Property Federation commissioned a survey which indicated that agreement has been reached on how to handle more than 80% of rent arrears incurred since the start of the COVID-19 pandemic.

Unfortunately, that still leaves a huge number of landlords and tenants in or on the verge of potentially protracted, expensive and even catastrophic legal disputes.

The Government acted to protect tenants who were struggling at the outset of the COVID-19 pandemic by imposing a moratorium, effectively a temporary ban, against various methods of escalating legal action by landlords. This included methods to evict, bankrupt or wind up commercial tenants, and required rent arrears beginning from 21st March 2020, during the period businesses were mandated to close, to be “ringfenced” pending the introduction of a binding arbitration scheme. The arbitration procedure will be used to determine any ongoing disputes between commercial landlords and tenants, rather than the courts being inundated by a flood of deferred claims when the moratorium ends.

Recent Developments

Following on from our last blog on the subject, Business Secretary Kwasi Kwarteng announced on 9th November 2021 that new laws (under the Commercial Rent (Coronavirus) Bill) and an updated Code of Practice are being introduced.

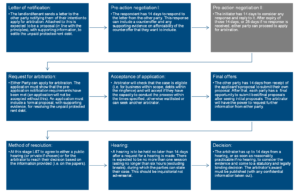

The intention seems to be to help preserve viable tenant businesses, but not at the expense of the solvency of the landlord. The exact nature of the arbitration scheme and its costs have not yet been finalised, but the below chart is found in Annex C of the Code and gives a clear indication of how much quicker the process is intended to be than a typical Court timescale.

Key Issues

-

Tenants must firstly understand that if they are in a position to pay the rent arrears in full, they are expected to make payment and not try to negotiate down the debt just because they can. Tenants may therefore have to provide evidence of why the payment is unaffordable and what figure or payment plan might be manageable in the near future. There is a non-exhaustive list of evidence that will be taken into account at Annex B of the updated Code. Assuming that the tenant is not in a financial position to settle the debt, the Code states that efforts should be made to negotiate with the landlord in the expectation that all or some of the rent arrears will be waived, if possible, as the underlying objective to preserve viable tenant businesses should not be prioritised at the expense of the solvency of the landlord.

-

Landlords and tenants should both take note that the entitlement to request arbitration is expected to last for six months after the Bill is due to be enacted, 25th March 2022. Court proceedings will remain under moratorium pending the determination of the arbitration and so landlords will likely prefer that efforts are made sooner rather than later to attempt arbitration, should negotiations in the meantime prove to be unsuccessful.

-

It is very important to understand that these laws only apply to businesses which were forced to close, even partly, from 21st March 2020, up to when the restrictions ended for their sector. Debts accrued before or after this period must be therefore treated separately to this “ringfenced” debt arbitration process.

-

Tenants will be pleased to hear that legal protections remain in force against pure debt claims seeking repayment of the COVID commercial rent arrears, including Court Judgments and bankruptcy petitions. Debt claims issued after 10th November 2021 which include ringfenced debts will be stayed (paused) with the court and referred to arbitration. County or High Court Judgments relating to ringfenced debt will also be subject to the arbitration procedure and may be cancelled following the arbitrator’s decision, and Bankruptcy Petitions will be similarly ineffective for claims within the protected period (21st March 2020 until the last date of any restrictions in the appropriate business sector).

-

Specific insolvency advice may be necessary if a company is facing or in a Compulsory Voluntary Arrangement (CVA), as a tenant cannot apply for arbitration of COVID arrears already under a CVA, but landlords may benefit from the fact that tenants cannot propose a CVA for 12 months following the date of the arbitrator’s decision, if there has been a referral to that scheme.

-

We do not know yet how much the arbitration scheme will cost, but it is expected to increase proportionately with the amount of the debt, so there may be even more incentive to reach an early settlement for parties on either side of a substantial balance due. Another similar impetus is the fact the repayment agreement cannot last more than 24 months, so tenants may be particularly motivated to negotiate a settlement before arbitration if they require more than two years to pay off the debt.

Conclusion

This is by no means an exhaustive list, as the Bill is currently still before the House of Commons and may well be amended during the Parliamentary approval process. Furthermore, the Code is still voluntary at the moment and could easily change as well in the coming months. There is clearly much more information to come about the end of the legal restrictions against pursuing COVID-19 commercial rent arrears, in addition to the arbitration scheme being set up to determine any continuing disputes between Landlords and Tenants, so keep an eye out for new blogs in this series keeping you up to date, and please reach out to a member of our team if you think we may be able to help!

Contact us on 0845 287 0939 or send your enquiry through our online contact form.